In today’s digital age, social media has become integral to our daily lives. From catching up with friends to following the latest trends, these platforms have revolutionized how we communicate and consume information. But did you know that social media also plays a significant role in shaping our financial decisions? Let’s dive into the fascinating world where likes, shares, and tweets intersect with dollars and cents.

The Social Media Revolution in Finance

How Social Platforms are Changing the Game

Gone are the days when financial advice was limited to stuffy boardrooms and lengthy consultations with suited professionals. Today, a wealth of financial information is just a scroll away on your favorite social media app. But is this a good thing? Let’s break it down.

The Good: Democratization of Financial Information

Social media has opened up a world of financial knowledge to everyone with an internet connection. Here’s how:

- Easy access to expert advice: Financial gurus and successful investors now share their insights directly with millions of followers.

- Real-time market updates: Platforms like Twitter have become go-to sources for breaking financial news.

- Community learning: Finance-focused groups on Facebook and Reddit allow users to share experiences and learn from each other.

The Bad: Information Overload and Misinformation

However, this flood of information comes with its own set of challenges:

- Conflicting advice: Knowing who to trust is hard with so many voices.

- FOMO (Fear of Missing Out): Seeing others’ success stories can lead to impulsive decisions.

- Scams and frauds: Social media has become a breeding ground for financial scams targeting unsuspecting users.

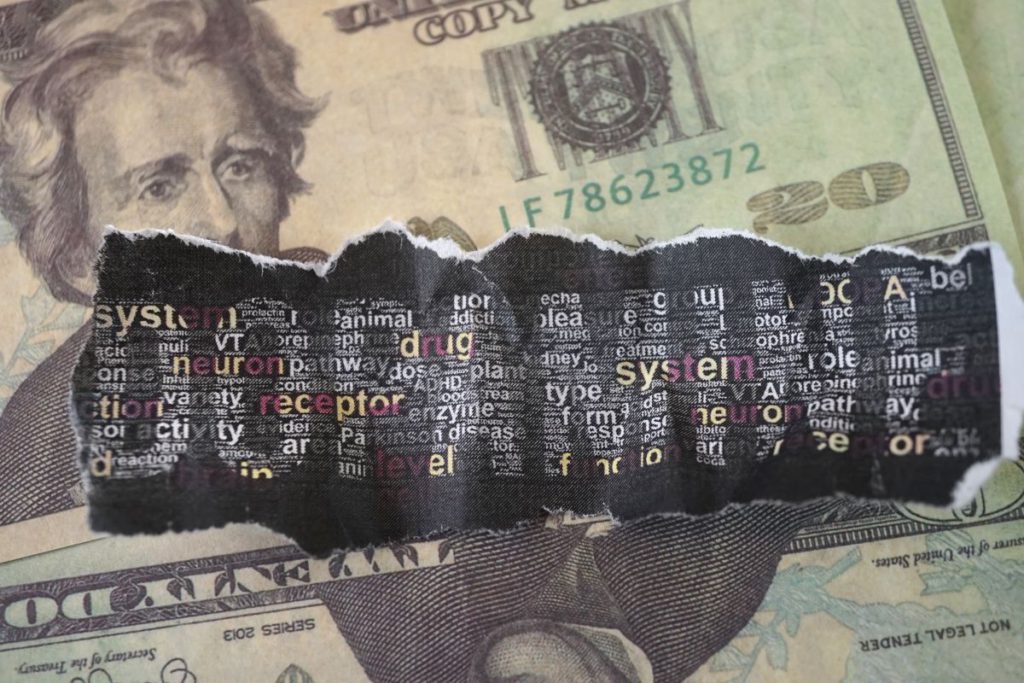

The Psychology of Social Media and Money

Why We’re Wired to Follow the Crowd

Have you ever wondered why jumping on the latest investment trend you see on social media is so tempting? It’s not just you – it’s human nature!

The Herd Mentality in Action

Humans are social creatures, and we’re hardwired to follow the crowd. This instinct, which once helped our ancestors survive in the wild, now influences our financial decisions in the digital jungle.

Example: Let’s say you see multiple posts about a new cryptocurrency that’s “going to the moon.” Even if you know little about it, you might want to invest. This is the herd mentality at work.

The Role of FOMO in Financial Decisions

Fear of Missing Out (FOMO) is a powerful emotion that social media amplifies. Seeing others seemingly getting rich quickly triggers our FOMO, often leading to hasty financial choices.

Calculation: Imagine you have $1,000 to invest. You see a post about a stock that’s grown 20% in a week. Your FOMO brain might think:

Potential Gain = $1,000 * 20% = $200

That sounds great, right? However, this simplistic calculation ignores the risks and that past performance doesn’t guarantee future results.

The Dopamine Effect: Likes, Shares, and Financial Decisions

Every like, share, or positive comment on a financial post gives us a little hit of dopamine – the feel-good chemical in our brains. This can create a dangerous feedback loop:

- See a popular financial tip.

- Act on it.

- Share your decision.

- Get positive reinforcement from your network.

- Repeat, potentially ignoring rational decision-making.

Navigating the Social Media Financial Landscape

Tips for Smart Financial Decision Making in the Digital Age

Now that we understand social media’s influence on our financial choices let’s explore how to navigate this landscape wisely.

- Diversify Your Information Sources

Don’t rely solely on social media for financial advice. Create a balanced information diet:

- Follow reputable financial news outlets

- Read books by established financial experts

- Consult with licensed financial advisors

Pro Tip: Add a respected financial publication or institution to your feed for every financial “guru” you follow on social media.

- Practice Critical Thinking

Before acting on any financial advice you see on social media, ask yourself:

- Who is sharing this information? What are their credentials?

- What’s their motivation for sharing? (Hint: It might be to sell you something)

- Do financial experts generally accept this advice?

Example: If someone on TikTok is promoting a “guaranteed 100% return” investment, your critical thinking alarm should be blaring!

- Understand the Power of Social Proof

Social proof – the idea that we look to others to guide our behavior – is particularly strong on social media. Be aware of how this influences you.

Calculation: Let’s say an investment post has 10,000 likes. That might seem impressive, but consider the following:

Platform Users = 1,000,000,000 (1 billion)

Engagement Rate = 10,000 / 1,000,000,000 = 0.001%

Suddenly, those 10,000 likes represent a tiny fraction of users. Don’t let raw numbers sway you without context.

- Implement the 24-Hour Rule.

Feeling the urge to make a financial move based on something you saw on social media? Wait 24 hours before acting. This cooling-off period allows you to:

- Research the topic thoroughly

- Consult with trusted advisors

- Evaluate how the decision fits into your overall financial plan

- Use Social Media as a Learning Tool, Not a Decision-Maker

Instead of using social media to make specific financial decisions, use it to:

- Learn new financial concepts

- Stay updated on market trends

- Discover different perspectives on money management

Pro Tip: Create a separate “Finance Learning” list or account to follow financial experts and institutions. This will help you separate educational content from the noise of your regular feed.

Real-Life Implementation: Building a Social Media Finance Strategy

Now that we’ve covered the principles let’s create a practical strategy for using social media in your financial journey.

Step 1: Audit Your Current Social Media Diet

Take stock of your current financial influences on social media:

- List all the finance-related accounts you follow

- Categorize them (e.g., Personal Finance, Investing, Cryptocurrency)

- Evaluate each based on credibility and value provided

Step 2: Curate Your Feed

Based on your audit:

- Unfollow accounts that consistently provide bad advice or make you feel anxious about money

- Add reputable financial institutions, certified advisors, and educational accounts

- Aim for a balance of different financial topics and viewpoints

Step 3: Set Boundaries

Establish rules for your social media financial engagement:

- Limit time spent browsing financial content (e.g., 30 minutes per day)

- Never make financial decisions immediately after seeing a post

- Always cross-reference information with reliable sources from social media

Step 4: Engage Actively, Not Passively

Don’t just consume content – interact thoughtfully:

- Ask questions on posts you find interesting

- Share your own experiences (within reason and without divulging personal financial details)

- Participate in financial literacy challenges or community discussions

Step 5: Use Social Media Tools to Your Advantage

Leverage platform features for a better financial experience:

- Use lists on Twitter to separate financial content from other topics

- Join focused Facebook groups for specific financial goals (e.g., debt payoff, retirement planning)

- Follow relevant hashtags on Instagram to discover new financial resources

Step 6: Regular Review and Adjust

Your financial journey is unique and evolving. Regularly assess your social media finance strategy:

- Monthly: Review the content you’ve engaged with and its impact on your financial decisions

- Quarterly: Reassess the accounts you follow and make adjustments

- Yearly: Reflect on how social media has influenced your overall financial health and make major strategy shifts if needed

Conclusion: Empowered Financial Decisions in the Social Media Era

Social media has undeniably changed the landscape of financial decision-making. When used wisely, it’s a powerful tool that can enhance your financial knowledge and help you make informed decisions. However, it’s crucial to approach social media finance with a critical eye and a healthy dose of skepticism.

Remember, your financial journey is personal. While social media can provide inspiration, education, and community, your decisions should ultimately align with your unique goals and circumstances. By implementing the strategies we’ve discussed, you can harness the power of social media to boost your financial literacy while avoiding its potential pitfalls.

As you navigate the exciting intersection of social media and finance, keep learning, stay curious, and always think twice before acting on financial advice from your feed. Your future self (and your wallet) will thank you for it!

Happy scrolling and intelligent saving!